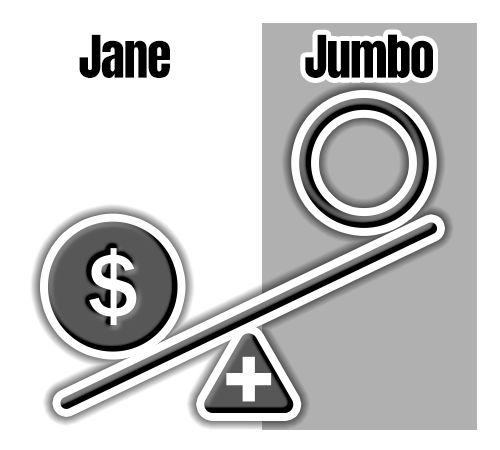

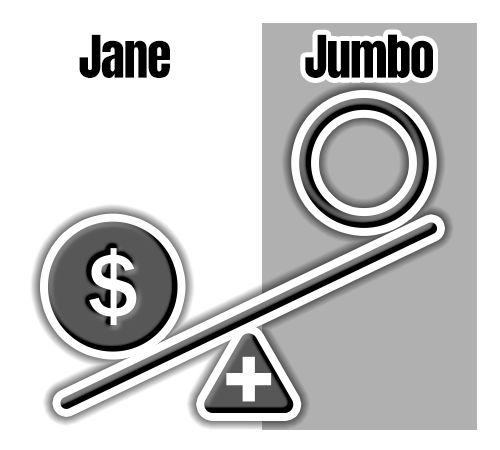

Early Calendar Year

Early in the year, Jane hasn't reached her $1500 deductible yet, so her plan doesn't pay any of the costs, while Jane pays 100% of her medical expenses. So if some office visits cost $150, Jane pays $150 and Jumbo pays $0

Early in the year, Jane hasn't reached her $1500 deductible yet, so her plan doesn't pay any of the costs, while Jane pays 100% of her medical expenses. So if some office visits cost $150, Jane pays $150 and Jumbo pays $0

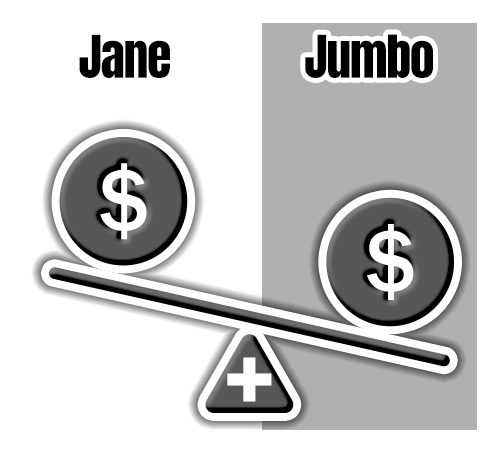

By the middle of the year, Jane reaches her $1500 deductible, so her co-insurance kicks in. After having visited the doctor several times, she has paid out of pocket the required $1500, and now Jane is responsible for 20% of her next $75 office visit. That means Jane pays $15 now, and Jumbo pays their 80% or $60.

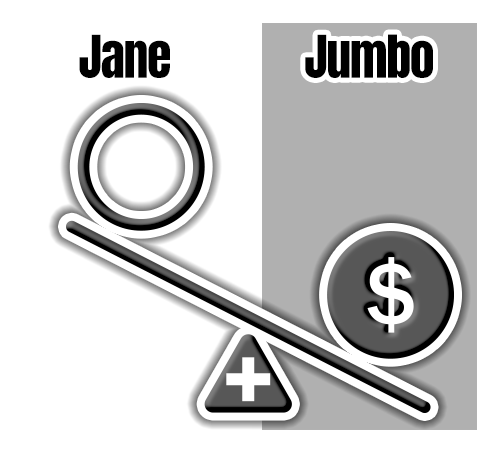

Toward the end of the year, Jane has finally reached her $5000 out-of-pocket limit, so now Jumbo covers all expenses. So after meeting her $1500 deductible and then paying 20% of all other costs for several months, Jane has satisfied her max out-of-pocket, which means that now $225 in office visits before December 31 will be covered completely by Jumbo. Then, on January 1, everything resets back to the original unsatisfied deductible and ceiling levels.